2/21/ · #1 Fibonacci Sequence in the Forex Market The sequence of numbers starts from zero and one, and then the next number comes with the addition of the previous two numbers. For example, the beginning of the sequence is 0, 1, 1, 2, 3, 5, 8, 13, 21, 34, 55, 89,, , , , , , , , 1/31/ · This golden ratio is found in the Fibonacci sequence and exists in almost everything if you know where to look. Even in forex. An Italian mathematician, Leonardo Fibonacci, discovered the Fibonacci sequence. The relationships among the numbers in the sequence are not only consistent in mathematical theory, but also in nature, architecture, and others 11/10/ · Fibonacci trading is becoming more popular, because traders have learned that Forex and stock markets react to the Fibonacci numbers. Fibonacci is the sequence of numbers discovered by Leonardo Fibonacci, an Italian mathematician: 0, 1, 2, 3, 5, 8, 13, 21, 34, 55, 89, , , , , , , , , , , , , , ,

How does the Fibonacci sequence help in Forex and stock trading? - blogger.com Blog

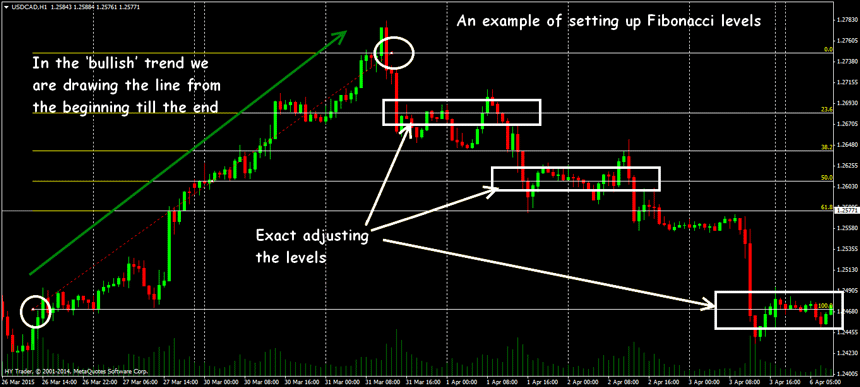

Fibonacci analysis can improve forex performance for both short and long-term positions, identifying key price levels that show hidden support and resistance. Fibonacci used in conjunction with other forms of technical analysis builds a powerful foundation for strategies that perform well through all types of market conditions and volatility levels.

While his studies were theoretical, these Fibonacci numbers show profitable applications in our modern financial fibonacci sequence forex, describing relationships between price waves within trends, as well as how far waves will carry before reversing and testing prior levels.

These secondary ratios have taken on greater importance since the s, due to the deconstruction of technical analysis formula by funds looking to trap traders using those criteria. As a result, whipsaws through primary Fibonacci levels have increased, fibonacci sequence forex, but harmonic structures have remained intact. For example, it was commonly believed the. That level fibonacci sequence forex now routinely violated, with the.

Traders and market timers have adapted to this slow evolution, altering strategies to accommodate a higher frequency of whipsaws and violations. Fibonacci grid applications can be roughly divided into two categories, historical analysis and trade preparation. The first category requires an examination of long-term forex trends, identifying harmonic levels that triggered major trend changes.

Active market players will spend more time focused on the second category, in which Fibonacci grids are placed over short term price action to build entry and exit strategies.

Since currency pairs oscillate between contained boundaries through nearly all economic conditionsthese historical levels can impact short-term pricing for decades. Given the small number of popular crosses compared to the stocks or bonds, it makes sense to perform a historical analysis on each pair, outlining primary trends and levels that might come into play in coming years, fibonacci sequence forex. Perform this task by zooming out to weekly or monthly charts, and placing grids across secular bull and bear markets.

EURUSD Historical Fibonacci Grid. The EURUSD currency pair came to life in the s near. It fell to an all-time low at. A grid placed over the massive uptrend has captured all price action in the last eight years. The initial decline off the rally high ended near the. Meanwhile, a breakdown found new support at the. Start your trade preparation analysis by placing a single grid across the largest trend on the daily chartidentifying key turning points. Next, add grids at shorter and shorter time intervals, looking for convergence between key harmonic levels.

Similar to trendlines and moving averagesthe power of fibonacci sequence forex levels tracks relative time frame, with grids on longer term trends setting up stronger support or resistance than grids on shorter term trends.

Many forex traders focus on day tradingand Fibonacci levels work in this venue because daily, and weekly trends tend to subdivide naturally into smaller and smaller proportional waves. Having a hard time figuring out fibonacci sequence forex to place starting and ending points for Fibonacci grids?

Stretching the grid across a major high and low works well in most cases but many traders take a different approach, using the first lower high after a major high or first higher low after a major low. This approach tracks the Elliott Wave Theoryfocusing attention on the second primary wave of a trend, which is often the longest and most dynamic. The reliability of retracement levels to stop price swings and start profitable counter swings directly correlates with the number of technical elements converging at or near that level.

For example, multiple grids on a daily chart that align the. Add a or bar moving average and odds increase further, encouraging bigger positions and a more aggressive trading strategy.

This methodology applies to exits as well, telling forex traders to take profits when price reaches a retracement level that shows multiple alignments. EURJPY Indicator Alignment. The EURJPY forex pair sells off from The countertrend wave crawls higher for four days, finally reaching the, fibonacci sequence forex. This raises odds the pair will turn lower in a profitable short sale. Add long-term Fibonacci grids to favorite currency pairs and watch price action near popular retracement levels.

Add shorter term grids as part of daily trade preparation, using alignments to find the best prices to enter and exit positions. Add other technical indicators and look for convergence with retracement levels, fibonacci sequence forex, raising odds that prices will reverse in profitable counter swings. Trading Strategies. Technical Analysis Basic Education. Beginner Trading Strategies. Your Money. Personal Finance. Your Practice. Popular Courses. Compare Accounts. Advertiser Disclosure ×.

The offers that appear in this table fibonacci sequence forex from partnerships from which Investopedia receives compensation.

Related Articles. Trading Strategies Fibonacci Techniques for Profitable Trading. Technical Analysis Basic Education How to Draw Fibonacci Levels and Set Retracement Grids. Beginner Trading Strategies Book Reliable Profits With Pullback Strategies.

Technical Analysis Basic Education Strategies for Trading Fibonacci Retracements. Partner Links. Related Terms Trend Trading Definition Trend trading is a style of trading that attempts to capture gains when the price of an asset is moving in a sustained direction called a trend. Fibonacci Channel Definition and Uses The Fibonacci channel is a variation of the Fibonacci retracement tool.

With the channel, support and resistance lines run diagonally rather than horizontally, fibonacci sequence forex. It is used to aid in making trading decisions. Forex Chart A forex fibonacci sequence forex graphically depicts the historical behavior, across varying time frames, of the relative price movement between two currency pairs.

Trade Price Response Definition and Example Trade price response is a technical analysis strategy that establishes a position based on what the price of a security does after it fibonacci sequence forex a threshold, fibonacci sequence forex. Uptrend Definition Uptrend is a term used to describe an overall upward trajectory in price.

Many traders opt to trade during uptrends with specific trending strategies. Phi-Ellipse Definition and Uses The Phi-Ellipse is a Fibonacci-based technical analysis tool used by traders to identify general market trends.

About Us Terms of Use Dictionary Editorial Policy Advertise News Privacy Fibonacci sequence forex Contact Us Careers California Privacy Notice. Investopedia is part of the Dotdash publishing family.

I tested Fibonacci Trading Strategy 100 TIMES to find the truth about Fibonacci Retracements

, time: 9:42Fibonacci Forex Trading

2/21/ · #1 Fibonacci Sequence in the Forex Market The sequence of numbers starts from zero and one, and then the next number comes with the addition of the previous two numbers. For example, the beginning of the sequence is 0, 1, 1, 2, 3, 5, 8, 13, 21, 34, 55, 89,, , , , , , , , 1/31/ · This golden ratio is found in the Fibonacci sequence and exists in almost everything if you know where to look. Even in forex. An Italian mathematician, Leonardo Fibonacci, discovered the Fibonacci sequence. The relationships among the numbers in the sequence are not only consistent in mathematical theory, but also in nature, architecture, and others The Fibonacci numbers are one of the most powerful tools of technical analysis in the Forex market. The use of the Fibonacci numbers in combinations with analytical tools to determine the limits of corrections and targets are very helpful for trading on Forex

No comments:

Post a Comment